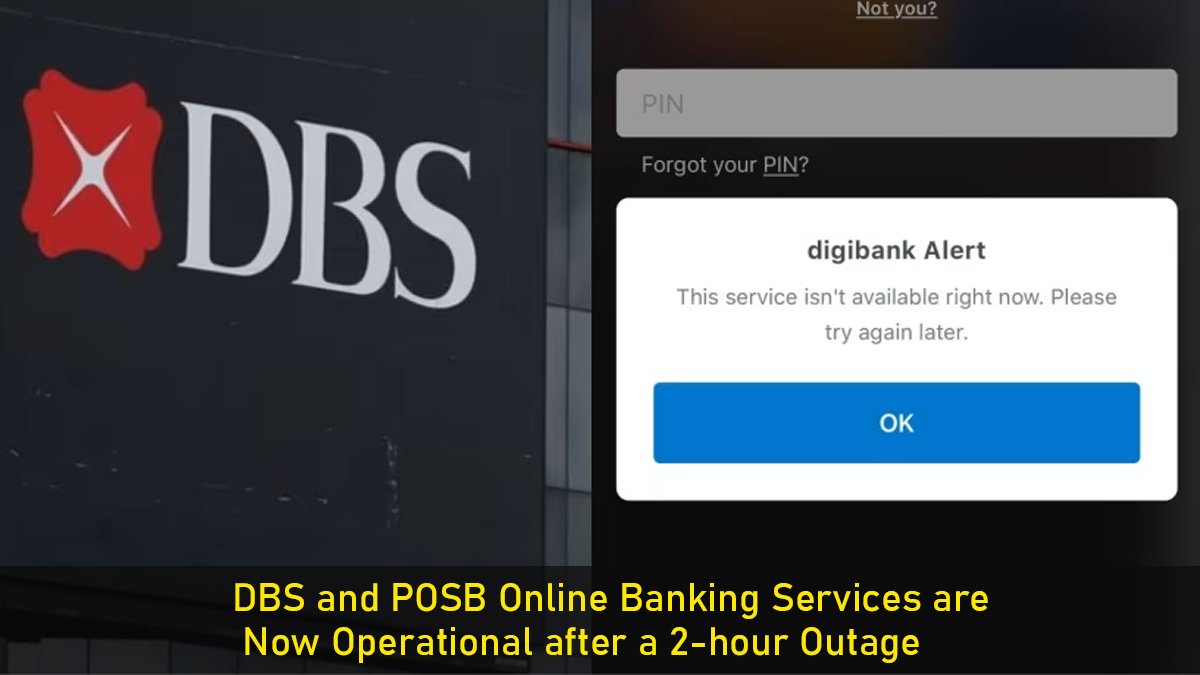

SINGAPORE-On May 2, several DBS/POSB customers encountered challenges when trying to access the digital services provided by Singapore’s largest bank. Starting from approximately 5.40 pm, numerous users experienced difficulties logging into their online bank accounts, and mobile applications, and utilizing PayLah!.

The Downdetector platform, known for monitoring service interruptions, documented over 2,200 complaints from individuals facing problems with DBS and POB’s services around 6.10 pm.

DBS Bank released a statement on Facebook at 6:54 pm addressing the ongoing problems customers were facing with DBS/POSB Digibank Online and Mobile, as well as DBS PayLah!

The statement assured customers that the issue had been identified, and steps were being taken to restore the services promptly.

Customer Satisfaction.

Customers were advised that they could still use their DBS/POSB credit or debit cards for payments, and if needed, they could locate the nearest ATM by visiting go.dbs.com/sg-locator.

Numerous dissatisfied customers expressed their grievances on social media platforms, detailing the negative impact they experienced due to the disruption. One Facebook user, Jess Thia, shared her frustration about being unable to make payment for her dinner during the busy dinner period.

Another user, Jimmy Tang, humorously remarked that the intention was to embrace a cashless society, but instead, they found themselves in a situation where they were cashless and unable to make payments. DBS provided an update at 9.10 pm, stating that their services were gradually being restored between 7.37 pm and 8.03 pm.

Timings all transactions or services

However, The Straits Times conducted checks at around 9.25 pm and discovered that certain users were still unable to perform high-risk transactions as several services remained unavailable.

In response to the disruptions of the bank’s services in 2023, a restriction was put in place. This restriction required the bank to allocate additional regulatory capital as a penalty for the service disruptions.

DBS announced on April 30 that they have been working on a technology resiliency roadmap since May 2023 to enhance the availability of their services to customers. Despite ongoing efforts to strengthen the bank’s systems architecture, there are still areas that are a “work in progress,” according to the bank’s statement.