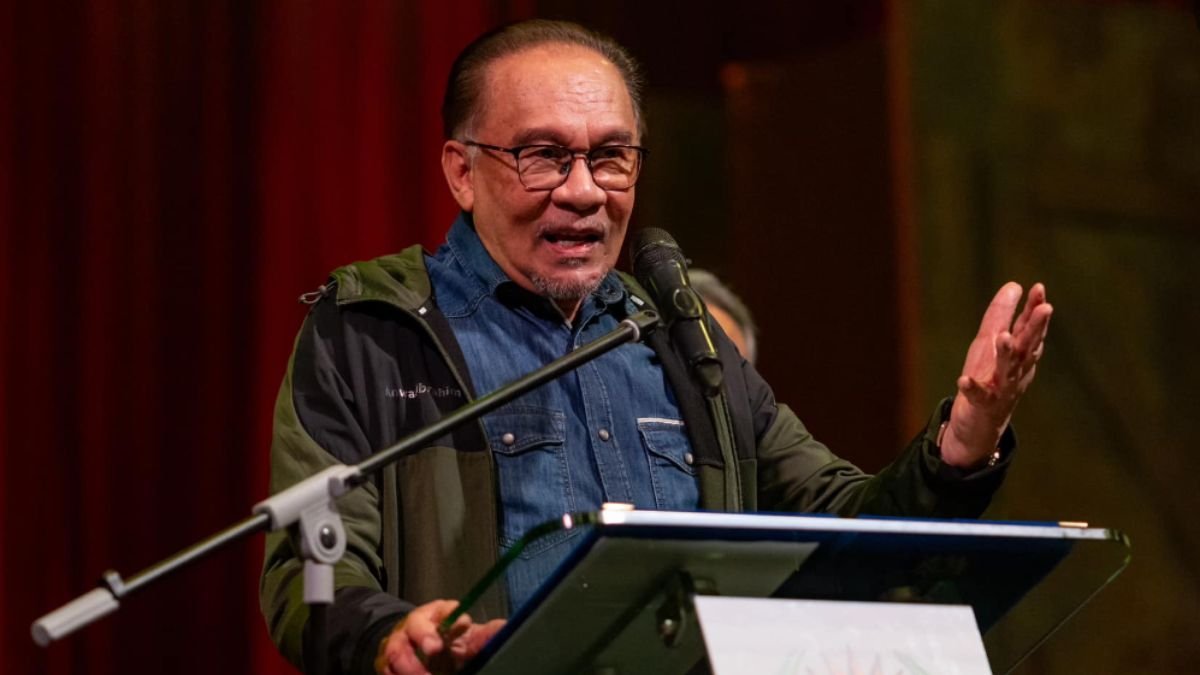

PUTRAJAYA: Prime Minister Anwar Ibrahim has said that any controversy related to the BlackRock issue linked to the Israeli regime could harm Malaysia’s interests as a developing country.

At today’s monthly meeting of the Prime Minister’s Department, PM Anwar urged all parties not to be “excessive” in discussions about the BlackRock issue.

Investment Presence and Malaysia’s Stance on Israel

Anwar, who is also Finance Minister, said the investment giant’s presence in Malaysia had not affected the country’s stance in being vocal against the Israeli regime’s atrocities against the people of Gaza.

“History shows that compared to other countries, we (Malaysia) are among the clearest and firmest (in voicing out against Israel). Don’t demand more than that. We are a developing country – look at our level of capability. Don’t let a strong desire to show off undermine the country’s interests. That is our principle in general,” said PM Anwar.

FOLLOW US ON X: CLICK HERE

“The cruelty that Israel committed against Palestine is very clear. No one is disputing it. If there is a company like Microsoft or Google showing sympathy towards Israel, we will oppose it. (However) do you think we should close all paths and cooperation with them?” he added.

BlackRock’s Financial Involvement in Malaysia

According to data reviews, BlackRock reportedly has interests and holdings worth RM24.7 billion in companies listed on Bursa Malaysia and RM7.9 billion in Malaysian government and corporate bonds.

The publicly available data reveals that as of May 2024 the global investment firm had stakes in 100 listed companies in Malaysia across all industry sectors, including three banking institutions.

Historical Context and Approval of BlackRock’s Entry

Anwar said then Prime Minister Dr Mahathir Mohamad in 2018 highlighted in London the need for the company’s entry into Malaysia, while in 2021, then Prime Minister Muhyiddin Yassin approved an EPF proposal for BlackRock to manage a special RM600 million EPF fund.

Collaboration with Global Infrastructure Partners (GIP)

Regarding Khazanah Nasional Bhd and EPF’s collaboration with Global Infrastructure Partners (GIP) over the interests in Malaysia Airports Holdings Bhd (MAHB), Anwar said the tie-up had existed since 2012.

“That is why Khazanah and EPF are negotiating with GIP. Our airports have their strengths and advantages, but compared to other major airports, there are many weaknesses, especially in terms of engineering, technical expertise and management,” he said.

“There are areas that need improvement because we are somewhat behind in planning and various other aspects. Khazanah and EPF’s decision was then communicated to me and I said to proceed,” he added.

Conditions for Sale of Stake in MAHB

Earlier, PM Anwar said the sale of stake in MAHB to GIP was carried out under strict conditions and that one of the advantages of the selection was the approval of the company, the appointment of Malaysians as Chairman and CEO of MAHB and the collective ownership of the majority shares by the state.

Anwar said the other parties had not accepted the conditions set by Khazanah and the EPF.

GIP’s Role and BlackRock Acquisition

GIP is a major infrastructure investor, managing $112 billion in assets on behalf of its investors, which include approximately 500 investment institutions worldwide.

It was announced in January that BlackRock would acquire GIP. The transaction is expected to close in the third quarter of 2024. BlackRock was not involved in any way in the transaction related to MAHB.

ALSO READ: PM Anwar Initiates RM250 Million Penang Hill Cable Car Project – Know All About It